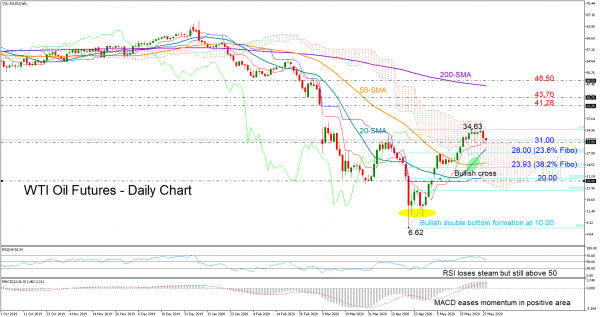

WTI crude oil futures for July delivery inched down on Wednesday after failing to lift the strong ceiling around 34.63 and jump above the Ichimoku cloud.

The price is now looking for support at April’s highs around 31.00 in order to pick up steam, though the weakening RSI and the slowing MACD are currently discouraging any upside move but not ruling it out as long as the former holds above its 50 neutral mark and the latter above its red signal line.

Should sellers drive oil below the 31.00 mark, the 20-day simple moving average (SMA) and the 23.6% Fibonacci retracement of the latest upleg at 28.00 could halt the downfall ahead of the 38.2% Fibonacci of 23.93, where the 50-day SMA is also flattenting. Another step lower would violate May’s uptrend, confirming additional losses towards the tough 20.00 barrier which is slightly below the 50% Fibonacci.

In the positive scenario where the oil price finds footing at 31.00, the bulls may push harder to extend the uptrend above the 34.63 top and towards the familiar 41.28-43.70 restrictive zone as the bullish cross within the 20- and 50-day SMAs currently suggests. Breaking higher, the 200-day SMA and the area around 48.50 may next come under the radar.

All in all, WTI oil futures may face some downside pressure in the short-term though the positive outlook is not expected to change unless the market deteriorates below 23.93. In the medium-term, the market direction remains to the downside and only a rally above 48.50 could shift it to neutral.