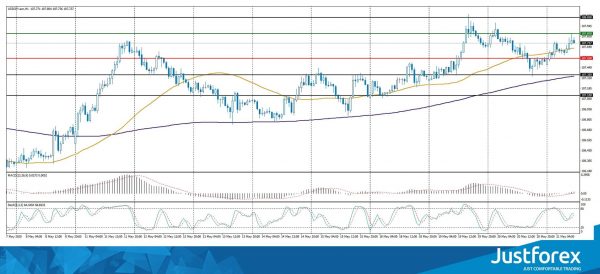

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.09169

Open: 1.09231

% chg. over the last day: +0.09

Day’s range: 1.09187 – 1.09601

52 wk range: 1.0777 – 1.1494

The EUR/USD currency pair has become stable after a sharp increase since the beginning of this week. The news that France and Germany have taken a joint initiative to create a €500bn EU rescue fund supports the euro. Currently, EUR/USD quotes are consolidating. The key range is 1.0920-1.0970. Today, investors will assess the FOMC meeting minutes, which may have a significant impact on the dynamics of currency majors. We recommend opening positions from key levels.

The Economic News Feed for 20.05.2020

Consumer price index in the Eurozone at 12:00 (GMT+3:00);

FOMC meeting minutes at 21:00 (GMT+3:00).

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.0950, 1.0920, 1.0900

Resistance levels: 1.0990, 1.1030, 1.1060

If the price fixes above 1.0990, further growth of EUR/USD quotes is expected. The movement is tending to 1.1030-1.1050.

An alternative could be a drop in EUR/USD quotes to 1.0920-1.0900.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.22539

Open: 1.22340

% chg. over the last day: -0.10

Day’s range: 1.21856 – 1.22439

52 wk range: 1.1466 – 1.3516

The technical pattern is still ambiguous on the GBP/USD currency pair. The British pound continues to consolidate. At the moment, the local support and resistance levels are: 1.2175 and 1.2225, respectively. Financial market participants expect additional drivers. Today, investors will assess important statistics on the UK and US economies. We recommend opening positions from key levels.

At 11:30 (GMT+3:00), a number of indicators on economic activity will be published in the UK.

Indicators do not give accurate signals: 50 MA has crossed 100 MA.

The MACD histogram is in the negative zone, which gives a signal to sell GBP/USD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.2175, 1.2135, 1.2075

Resistance levels: 1.2225, 1.2280, 1.2325

If the price fixes above 1.2225, GBP/USD quotes are expected to rise. The movement is tending to 1.2270-1.2300.

An alternative could be a decrease in the GBP/USD currency pair to 1.2140-1.2100.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.39402

Open: 1.39005

% chg. over the last day: -0.29

Day’s range: 1.38985 – 1.39468

52 wk range: 1.2949 – 1.4668

The USD/CAD currency pair is still being traded in a flat. There is no defined trend. The local support and resistance levels are: 1.3910 and 1.3960, respectively. The loonie is supported by the recovery of oil quotes. We expect important economic releases from the US. The USD/CAD currency pair has the potential for further decline. Positions should be opened from key levels.

The news feed on Canada’s economy is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates the bearish sentiment.

Trading recommendations

Support levels: 1.3910, 1.3870

Resistance levels: 1.3960, 1.4020, 1.4065

If the price fixes below the support level of 1.3910, a further drop in USD/CAD quotes is expected. The movement is tending to 1.3870-1.3850.

An alternative could be the growth of the USD/CAD currency pair to 1.4000-1.4030.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 107.699

Open: 107.473

% chg. over the last day: -0.17

Day’s range: 107.473 – 107.848

52 wk range: 101.19 – 112.41

There is an ambiguous technical pattern on the USD/JPY currency pair. The trading instrument is in a sideways trend. There is no defined trend. At the moment, the local support and resistance levels are: 107.55 and 107.85, respectively. Financial market participants expect additional drivers. We recommend paying attention to the dynamics of US government bonds yield. Positions should be opened from key levels.

Japan published weak trade balance data.

Indicators do not give accurate signals: the price is consolidating near 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line has started crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 107.55, 107.35, 107.10

Resistance levels: 107.85, 108.05

If the price fixes above 107.85, further growth of USD/JPY quotes is expected. The movement is tending to 108.10-108.30.

An alternative could be a decrease in the USD/JPY currency pair to 107.35-107.10.