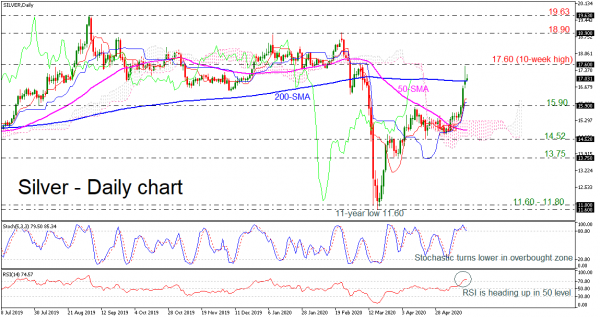

Silver has climbed considerably higher on Monday, resting near a fresh ten-week high of 17.60, surpassing a strong key level – the 200-day simple moving average (SMA) – but the price failed to end the day above it. The momentum indicators suggest an overbought market as the stochastic completed a bearish cross within the %K and %D lines above the 80 level and the RSI is holding above 70, pointing upwards.

A clear increase above 17.60 would bring the white metal towards the 18.90 resistance and may set the stage for more advances. Such a jump may carry more upside extensions and may open the path for the next resistance at 19.63, identified by the peak of September 2019.

Should the price stretch south, the inside swing high from 15.90 could provide support before the price touches the upper surface of the Ichimoku cloud at 15.27. A step lower could bring the 50-day SMA at 14.90 into play ahead of the 14.52 barrier. If the sell-off extends, attention could then turn to the 13.75 low.

To sum up, the market is expected to hold bullish in the short term and neutral in the medium term.