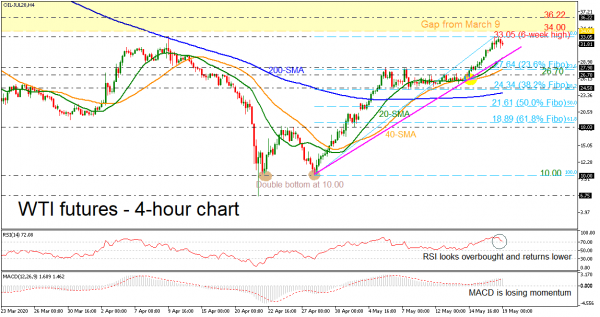

WTI futures for July delivery advanced to a fresh six-week high of 33.05 on Monday before pulling slightly back, opening the way for more bullish actions on the 4-hour chart. The price has been creating an upside trend since April 28, and the 20- and 40-period simple moving averages (SMAs) posted a bullish crossover in the preceding sessions, backing the positive structure.

The technical indicators send overbought signals, suggesting a possible pullback. The RSI has peaked above the 70 level and is heading south, while the MACD is losing momentum in the positive area.

A potential decline could send prices near the uptrend line which coinsides with the 20-period SMA currently at 29.51. This barrier could act as a strong support for a rebound, however, if the price continues the fall, it could touch the 27.90 level and the 23.6% Fibonacci retracement level of the up leg from 10.00 to 33.05 at 27.64. The latter overlaps with the 40-period SMA, a break of which could bring the 26.70 obstacle next under the spotlight and before the 38.2% Fibo of 24.34 attracts attention.

Alternatively, a climb above the six-week high could give signals for more upside moves towards the gap from March 9 formed between 34.00 and 41.20. Inside this area, the 36.22 resistance may add some pressure as well.

All in all, oil prices are bullish as long as they hold above the 200-period MA. In case the price violates this line, the bears could take the upper hand.