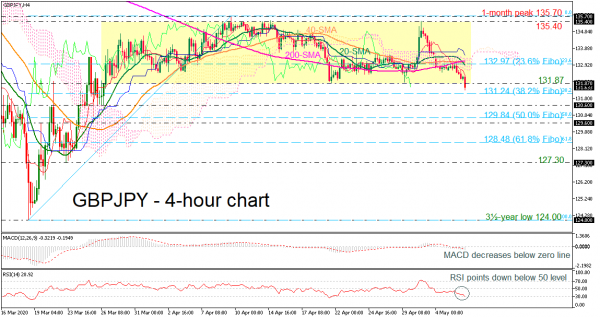

GBPJPY continues to fall below the Ichimoku cloud and the simple moving averages (SMAs) in the 4-hour chart over the last couple of days, penetrating the consolidation area, which had been holding since March 26.

According to the MACD, negative momentum could push for further losses in the short-term as the indicator picks up steam below its red signal line. The RSI is also decreasing, and it is relatively close to the oversold threshold; positive corrections cannot be excluded if there is a drop below 30.

In the negative scenario, where the price continues to expand lower, a new trough could be formed around the 38.2% Fibonacci retracement level of the upward wave from 124.00 to 135.70 at 131.24. If the market manages to break that area, traders could look for support at 130.60 before steeper bearish actions take the price down to the 50.0% Fibonacci of 129.84, increasing negative sentiment in the short-term.

A reversal to the upside could stall at the 23.6% Fibo of 132.97, which lies near the bearish cross within the 200-period SMA and the 20- and 40-period SMAs and is acting as a crucial resistance level. Further up, the 135.40 barrier, taken from the latest high, could also provide resistance and any violation at this point could potentially break to the upside the range, hitting 135.70.

To sum up, the short-term bias is neutral to bearish as GBPJPY is in the process of penetrating the sideways channel to the downside, recording a new six-week low.