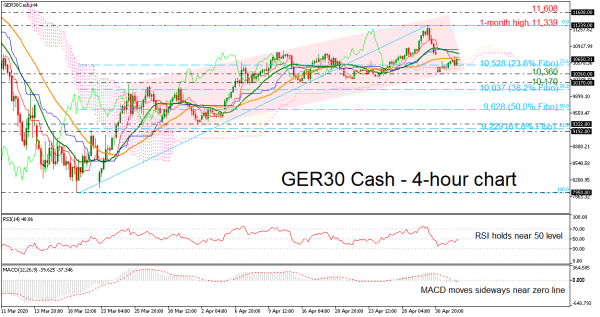

The GER 30 index (Cash) has been making higher highs and higher lows since the mid of March when it touched the new trough of 7,950, pausing the previous downtrend in the short-term. The technical indicators continue to send weak positive signals, suggesting either a pause in the continuation of the bullish bias may be turning close to an end.

The RSI is pointing up approaching the 50 level, while the MACD is hovering near the zero line, but it remains below this significant level. However, the Ichimoku indicators raise bearish flags as the red Tenkan-sen line is below the blue Kijun-sen line and is currently pointing to the downside.

Should prices increase, immediate resistance could be found around the 40-period simple moving average (SMA) at 10,683 ahead of the 20-period SMA at 10,775. Then a leg above these lines, the index could meet the one-month high of 11,339 before challenging the 11,608 resistance, achieved from an inside swing low on March 2.

However, if the market manages to lose speed and fall beneath the upward sloping channel, the 10,360 support could offer nearby support. A significant close below the latter could break 10,170 and the 38.2% Fibo of 10,037, raising chances for further decreases. In this case, prices could dive towards the 50.0% Fibo of 9,628.

In the short-term, the outlook remains positive, since prices hold within the ascending channel over the last couple of months, despite that the index hovers below the 20- and 40-period SMAs in the 4-hour chart.