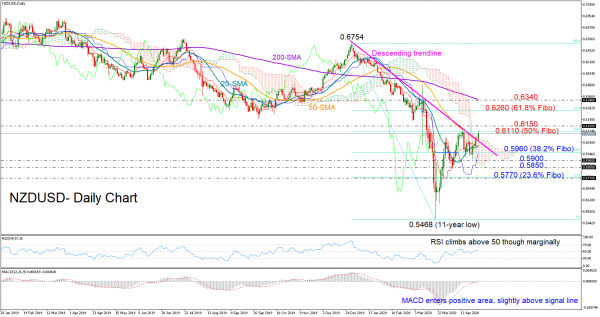

NZDUSD picked up speed to break above the strong descending trendline and the Ichimoku cloud but it remains to be seen whether the price can finish the day on top of these barriers.

Both the MACD and the RSI are somewhat optimistic that positive momentum could hold as the former has climbed above its 50 neutral mark, though marginally, and has yet to overcome its previous high, while the latter has slightly surpassed its zero and signal lines.

That said, whether the price can maintain strength in the short-term may depend on the 0.6110 key resistance that kept the market under the trendline earlier this month. The 50% Fibonacci is also at the same location, adding extra importance to the area. Should it collapse, with the 0.6150 level letting the bulls pass as well, the pair could rally until the 61.8% Fibonacci of 0.6260. Running higher, the next target could be the 0.6340 barrier, where the 200-day SMA is currently positioned. Any additional gains would improve the medium-term outlook from bearish to neutral.

Alternatively, if the 0.6110 mark again proves difficult to breach, the trendline could provide some footing to the market. If not, the sell-off may continue until the 0.5900-0.5960 restrictive zone, while below April’s low of 0.5850 and under the Ichimoku cloud, more losses could follow, with the 23.6% Fibonacci of 0.5770 coming into view first.

Summarizing, NZDUSD is gathering positive traction above the descending trendline, with traders eagerly awaiting a decisive close above the 0.6110-0.6150 area to increase buying orders. In the medium-term, an outlook upgrade to neutral could emerge above 0.6340.