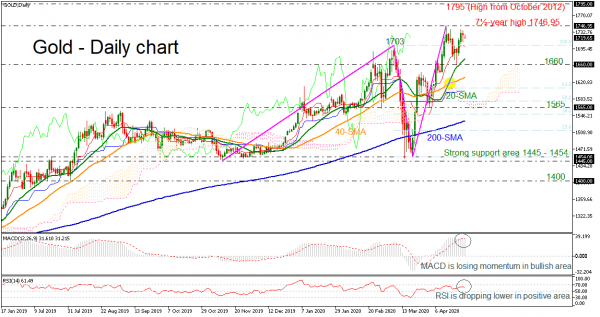

Gold prices successfully surpassed the previous high of the 1,703 strong barrier, confirming the upside tendency in the short- and medium-term timeframes. The yellow metal challenged a new fresh seven-and-a-half-year high of 1,746.95 on April 14 and is currently hovering slightly below this level.

The momentum indicators are failing to improve the positive picture on price action. The MACD oscillator slipped beneath the trigger line and is losing some ground, while the RSI is pointing marginally to the downside in the positive area. However, the 20- and 40-day simple moving averages (SMAs) posted a bullish crossover suggesting more gains in the short-term.

To the upside, immediate resistance is coming from the multi-year peak of 1,746.95 ahead of the crucial level of 1,795, taken from the highs on October 2012. An extension above the latter level prices could be sent towards the 161.8% Fibonacci extension level of the downward wave from 1,703 to 1,454 at 1,857.

On the flip side, if the prices lead lower, they could find support at the 1,660 mark, identified by the latest lows, but first it needs to battle with the 20-day SMA at 1,673. More losses could drive the market towards the 40-day SMA at 1,632 before touching the lower surface of the Ichimoku cloud at 1,565. Below that, the 200-day SMA at 1,534 is coming next.

Overall, gold prices are holding in positive territory – above 1,660 – despite the falling mode on technical indicators in the short-term.