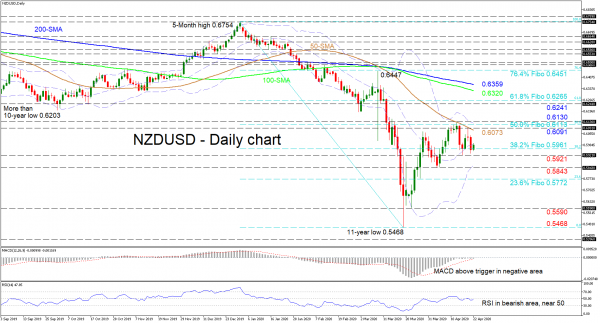

NZDUSD has turned flat around the 0.5961 level, that being the 38.2% Fibonacci retracement of the down leg from 0.6754 to 0.5468. This comes after the pairs’ recent lunge up from 0.5843, which hit a snag at the 50.0% Fibo of 0.6113 and the capping 50-day simple moving average (SMA).

Looking at the short-term oscillators, although in bearish territory, reflect a slight improvement in price. The MACD is just below zero but above its red trigger line, while the RSI, beneath the 50 mark is rising. However, traders need to keep track of the prevailing negative signals displayed within the SMAs.

If buyers manage to push above the mid-Bollinger band, they could face an initial fortified resistance region from the 50-day SMA at 0.6073 to the nearby swing peak of 0.6130, which includes the 0.6091 high, the 50.0% Fibo of 0.6113 and the upper Bollinger band. Overrunning these constrictions, the price may rally for the 0.6241 hurdle and the 61.8% Fibo of 0.6265 overhead. If buyers sustain the climb, the focus could turn to the 100- and 200-day SMAs at 0.6320 and 0.6359 respectively ahead of the 76.4% Fibo of 0.6451.

To the downside, a thrust under the 38.2% Fibo of 0.5961 and the 0.5921 low could be challenged by the lower Bollinger band and 0.5843 trough. Descending further, the 23.6% Fibo of 0.5772 would need to give way for the bears to dive for the 0.5590 support prior to re-visiting the 11-year low of 0.5468.

Overall, in the short-term timeframe the pair remains bearish below 0.6130. Yet, in the near-term picture, a neutral bias could endure prior to a break above 0.6130 or below 0.5921 signalling the next direction.