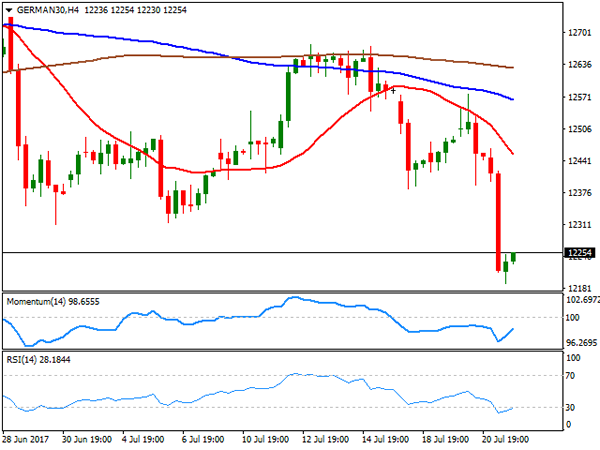

European equities plunged on Friday, amid EUR’s strength and local disappointing earnings reports. The German DAX shed 203 points or 1.66%, to settle at 12,240.66, its lowest since late April, with all of the thirteen members closing in the red. Infineon Technologies was the worst performer, shedding 4.53%, followed by Volkswagen that lost 3.93%. The continued strength in the local currency is making local products less competitive worldwide, and further gains in the common currency will likely continue denting local investors’ confidence. From a technical point of view, the daily chart shows that the index extended sharply below a bullish 100 DMA for the first time this year, also below a bearish 20 DMA and with technical indicators heading sharply lower within bearish territory. In the 4 hours chart, the index is below all of its moving averages, with the 20 SMA heading south almost vertically, and technical indicators bouncing, but still far below their mid-lines, and far from anticipating a recovery, as the RSI indicator remains at 28.

Support levels: 12,234 12,190 12,153

Resistance levels: 12,278 12,310 12,367