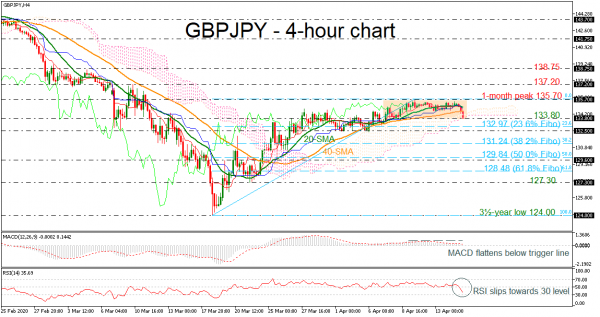

GBPJPY looks to be mostly neutral after an ascent from the three-and-half-year low of 124.00 that returned the price back above the 135.70 hurdle, overcoming the Ichimoku cloud.

The short-term oscillators reflect a stall in the positive momentum. The MACD, in the positive area, has moved near the zero level, while the RSI slipped below the 50 level and is increasing its bearish structure. That said, a conflicting bearish picture is currently displayed within the Ichimoku lines and all the SMAs.

To the upside, an initial important resistance region from the one-month peak of 135.70, could prove difficult to overrun. Conquering this, the 137.20 high, taken from March 10, could halt the climb towards the 138.75 barrier from March 5.

Otherwise, if sellers manage to close decisively below the Ichimoku cloud and the 133.80 support, the 23.6% Fibonacci retracement level of the up leg from 124.00 to 135.70 at 132.97 could deter the price from encountering the 132.50 region. Falling below this, the 38.2% Fibonacci of 131.24 may challenge bears’ efforts to revisit the 50.0% Fibonacci of 129.84.

In the very short-term window, GBPJPY has been in a sideways move over the last week, with indicators signaling for a downside move. However, in the medium-term view, the price is still in positive path.