The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.09084

Open: 1.09786

% chg. over the last day: +0.60

Day’s range: 1.09570 – 1.09908

52 wk range: 1.0777 – 1.1494

The bullish sentiment still prevails on the EUR/USD currency pair. Quotes have updated local highs again. Greenback demand remains at a fairly low level. Today, financial market participants will assess a number of important economic releases from the US, which may affect the further alignment of forces on currency majors. Currently, EUR/USD quotes are consolidating. The key range is 1.0950-1.0990. We do not rule out further growth of the single currency. Positions should be opened from key levels.

The Economic News Feed for 15.04.2020

Report on retail sales in the US at 15:30 (GMT+3:00);

Industrial production in the US at 16:15 (GMT+3:00);

Fed’s “Beige Book” at 21:00 (GMT+3:00).

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is in the oversold zone, the %K line is below the %D line, which indicates the bearish sentiment.

Trading recommendations

Support levels: 1.0950, 1.0915, 1.0885

Resistance levels: 1.0990, 1.1030, 1.1050

If the price fixes above 1.0990, further growth of the EUR/USD currency pair is expected. The movement is tending to 1.1020-1.1040.

An alternative could be a drop in EUR/USD quotes to 1.0920-1.0900.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.24975

Open: 1.26187

% chg. over the last day: +0.90

Day’s range: 1.25500 – 1.26308

52 wk range: 1.1466 – 1.3516

The GBP/USD currency pair has become stable after a prolonged rally. Investors have started to fix positions on the British pound partially. At the moment, the local support and resistance levels are 1.2535 and 1.2600, respectively. We expect the publication of important statistics from the US. We also recommend following the latest information regarding the COVID-19 spread. Positions should be opened from key levels.

The news feed on the UK economy is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram has started to decline, which signals a possible correction of the GBP/USD currency pair.

Stochastic Oscillator is in the oversold zone, the %K line is below the %D line, which gives a weak signal to sell GBP/USD.

Trading recommendations

Support levels: 1.2535, 1.2480, 1.2440

Resistance levels: 1.2600, 1.2645

If the price fixes above 1.2600, further growth of GBP/USD quotes is expected. The movement is tending to 1.2650-1.2680.

An alternative could be a decrease in the GBP/USD currency pair to 1.2490-1.2460.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.38912

Open: 1.38861

% chg. over the last day: -0.15

Day’s range: 1.38764 – 1.39775

52 wk range: 1.2949 – 1.4668

USD/CAD quotes have been growing. The trading instrument has updated local highs. The loonie is under pressure due to a sharp decline in the “black gold” prices. At the moment, the key support and resistance levels are 1.3925 and 1.4000, respectively. Investors have taken a wait-and-see attitude before the Bank of Canada meeting. It is expected that the regulator will keep the key marks of monetary policy at the same level. It should be recalled that last month the regulator lowered interest rates from 1.75% to a record low of 0.25%. We recommend opening positions from key levels.

At 17:00 (GMT+3:00), the Bank of Canada will announce its key interest rate decision.

Indicators do not give accurate signals: the price has fixed between 50 MA and 100 MA.

The MACD histogram has started to rise, indicating the development of bullish sentiment.

Stochastic Oscillator is in the overbought zone, the %K line is above the %D line, which gives a weak signal to buy USD/CAD.

Trading recommendations

Support levels: 1.3925, 1.3855, 1.3800

Resistance levels: 1.4000, 1.4070, 1.4140

If the price fixes above the round level of 1.4000, further growth of USD/CAD quotes is expected. The movement is tending to 1.4040-1.4070.

An alternative could be a decrease in the USD/CAD currency pair to 1.3870-1.3840.

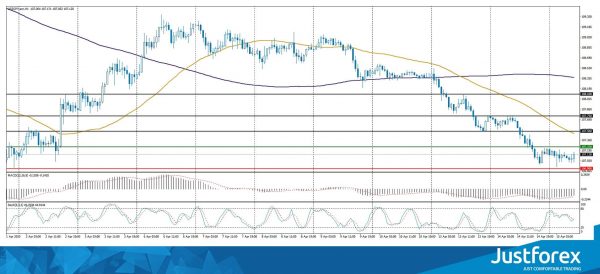

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 107.745

Open: 107.211

% chg. over the last day: -0.45

Day’s range: 106.927 – 107.211

52 wk range: 101.19 – 112.41

The USD/JPY currency pair continues to show a steady downtrend. The trading instrument has updated local lows again. Demand for the “safe haven” currencies is still high amid the spread of the coronavirus pandemic. Nevertheless, in the near future, we do not exclude the technical correction of the USD/JPY currency pair. At the moment, USD/JPY quotes are consolidating in the range of 106.90-107.25. Economic reports from the US are in the spotlight. Positions should be opened from key levels.

The news feed on Japan’s economy is calm.

Indicators signal the power of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, indicating the bearish sentiment.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 106.90, 106.50

Resistance levels: 107.25, 107.50, 107.75

If the price fixes below 106.90, a further drop in the USD/JPY quotes is expected. The movement is tending to 106.60-106.30.

An alternative could be the growth of the USD/JPY currency pair to 107.50-107.80.