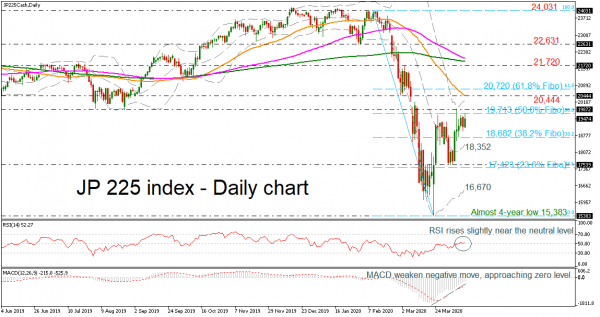

The JP 225 index stretched its two-month old downside rally to an almost four-year trough of 15,383 before retracing half of the decline.

The MACD seems to be gaining ground towards the zero line, the RSI is still hovering around its 50 neutral mark and the simple moving averages (SMAs) continue to point south, all signaling a more cautious trading in the short-term.

In case of a bullish correction, the index needs to overcome the 50.0% Fibonacci of the bearish move from 24,031 to 15,383 at 19,713, and the 19,872 resistance before heading up to the 20,444-20,720 area, which includes the 50-day SMA, the upper Bollinger band, and the 61.8% Fibonacci. Clearing that key zone, the next stop could be around 21,720.

Alternatively, the price needs to slip below the 38.2% Fibonacci of 18,682 and the mid-Bollinger band at 18,352 to revisit the area near the 23.6% Fibonacci of 17,423. Lower, the 16,670 level, where the lower Bollinger band is standing could come next.

In short, the sentiment turned slightly bullish after the price rebounded on the almost four-year low. However, the bearish pressure has not faded yet according to the technical indicators.