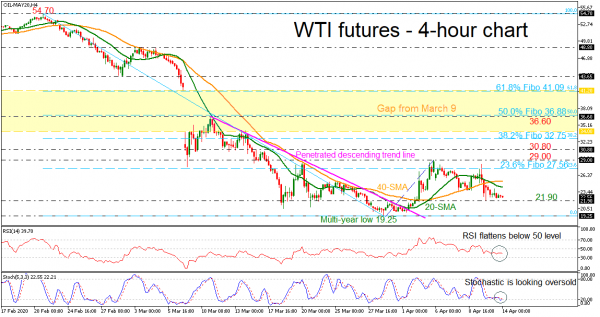

WTI crude oil futures have been on the sidelines over the last couple of days as the 23.6% Fibonacci retracement level of the down leg from 54.70-19.25 at 27.56 seems to be a struggle for the bulls. The price could lose some more ground in the short-term, according to the RSI, as it is changing direction to the downside. However, the stochastics are warning over an oversold market, forming a bullish crossover within the %K and %D lines.

A rebound on the 21.90 support could keep the commodity on the sideways movement started on April 2. Should the price overcome the 20- and 40-period simple moving averages (SMAs), resistance could run up to the 23.6% Fibo of 27.56 and the 29.00 handle. Higher, the 30.80 barrier and the 38.2% Fibonacci mark of 32.75 may also prove a challenge, switching the 4-hour chart to slightly bullish.

Alternatively, a decline under 21.90, could meet a strong barrier at the multi-year trough of 19.25. Dropping below this line, the 19.00, 18.00 and 17.00 round numbers could take control. Moreover, the 161.8% Fibonacci mark of 13.20 is coming lower, taken from the up leg from 19.25 to 29.00.

In the medium-term picture, oil prices are still in a strong negative profile over the past three-and-a-half months.