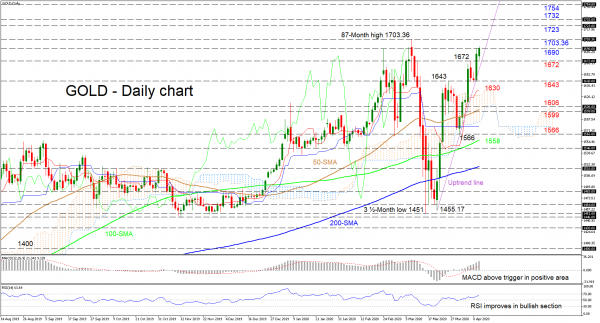

Gold is presently attempting to breach the 1,690 resistance, after holding above the near-term uptrend line drawn from March 20. The recent positive price action off the ascending line appears to be reflected in a bullish crossover of the Kijun-sen line by the upward sloping Tenkan-sen line.

The short-term oscillators continue to confirm the positive sentiment from the 1,566 level, with the MACD, in the positive region, increasing above its red trigger line while the RSI gradually advances in the bullish territory.

If the bulls maintain the bounce off the uptrend line past the 1,690 level, the tough 87-month high could be next to challenge the advance in the precious metal. Conquering this peak, the 1,723 resistance from December 2012 could take charge ahead of the 1,732 level. Overrunning these congested barriers, the 1,754 high from November of 2012 could draw focus, if buyers persist.

Otherwise, if sellers dive below the supportive line first to test the down move is the 1,672 inside swing high ahead of a key low of 1,643. Moving underneath, the upper band of the Ichimoku cloud around 1,630, where the Tenkan-sen line also is located, could come next. Steering lower, the support region of 1,606 – 1,599, which also encompasses the 50-day SMA, could attempt to halt further loss of ground towards the 1,566 trough and the 100-day SMA at 1,558 beneath.

Overall, Gold sustains its positive outlook in the short-term – holding way above the Ichimoku cloud and the rising SMAs. A break above the 1,703.36 summit could turbo charge the appreciation in the yellow metal, while a close below 1,643 could see a bearish-to-neutral bias returning in the short-term picture.