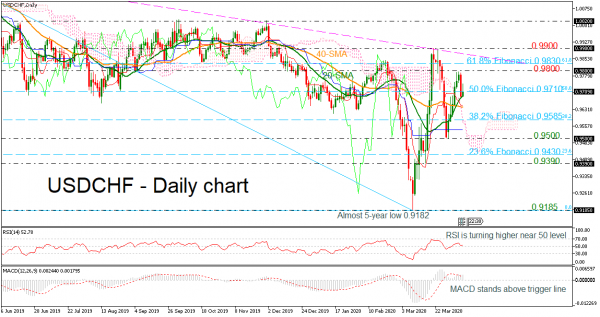

USDCHF found some footing at the 0.9500 handle on March 30, extending its bullish action towards the 0.9800 key level. Also, earlier today, the pair touched the 20-day simple moving average (SMA) at 0.9680 and turned higher again.

In the short-term, the market could retain the slightly bullish trading as the RSI holds marginally above its 50 neutral mark and the MACD remains above zero and close to its red trigger line. The upside move could stay in place given that prices continue to fluctuate above the bullish cross within the 20- and 40-SMAs.

In the positive scenario, where the price continues to expand above today’s high and the 0.9800 round number, a new top could be formed around the 61.8% Fibonacci retracement level of the down leg from 1.0235 to 0.9185 at 0.9830 around the long-term descending trend line, which has been holding over the last year. A penetration of this critical line could open the way for the 0.9900 resistance, identified by the high on March 20 ahead of the next barrier at 1.0020.

A reversal to the downside could stall near the Ichimoku cloud and the 38.2% Fibo of 0.9585. Any violation at this point could potentially trigger a further sell-off in the market, probably leading the price down to 0.9500, before meeting the 23.6% Fibonacci at 0.9430.

To sum up, the short-term bias is bullish, though the index could be close to overbought levels as the price is moving near the falling trend line with the medium-term outlook being negative.