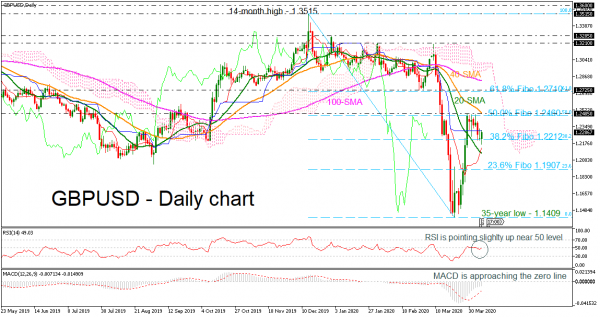

GBPUSD paused its bullish rally near the 50.0% Fibonacci retracement level of the down leg from 1.3515 to 1.1409 at 1.2460, which encompasses the 40-day simple moving average (SMA). The upside action helped the price to cover some of the previous month’s significant losses and turned the short-term bias to neutral.

Regarding the technical indicators, the RSI is pointing to the upside with weak momentum and is touching the 50 level, while the MACD oscillator is edging higher, holding well above its trigger line, but is still hovering beneath the zero line. Both are showing some positive improvement.

In case that the price fails to slip below the crucial 38.2% Fibonacci at 1.2212 and extends its increase, it could hit the 50.0% Fibonacci at 1.2460 and the 1.2485 resistance level. More upside pressure could drive investors towards the next key resistance at the 61.8% Fibonacci of 1.2710, around the 1.2725 barrier. Above that, the 100-day SMA is waiting for a retest currently at 1.2822.

In the negative scenario, a sell-off below the 38.2% Fibo and a slip under the Ichimoku cloud could meet the 20-day SMA at 1.2070 ahead of the 23.6% Fibonacci of 1.1907. A downside rally could open the way for the 35-year low of 1.1409, confirming a range-bound market.

To summarize, GBPUSD has been in a trendless market since March 13 as the price bounced back after the downfall. A jump above the 1.3515 level could add some optimism for a bullish outlook while a slip below 1.1409 could push the pair towards a new bearish path.