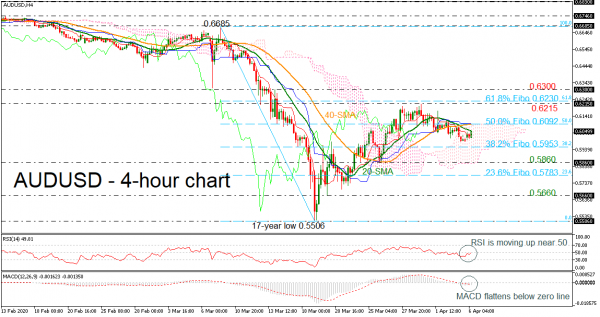

AUDUSD has been in a slightly declining wave after the touch on the 0.6215 resistance, entering the Ichimoku cloud and being capped by the 20- and 40-period simple moving averages (SMAs) in the 4-hour chart.

According to the momentum indicators, the RSI is pointing up near the neutral threshold of 50, gaining some ground, while the MACD is heading sideways, marginally below the zero level. In contrast, in the previous sessions, the moving averages posted a bearish cross suggesting more losses.

In case of a bounce off the 20-period SMA, the price could challenge the 38.2% Fibonacci retracement level of the down leg from 0.6685 to 0.5506 at 0.5953. Lower still, the 0.5860 support, which overlaps with the lower surface of the Ichimoku cloud, would come into spotlight before flirting with the 23.6% Fibonacci of 0.5783.

Upside moves are likely to find resistance at the 50.0% Fibonacci of 0.6092, which coincides with the 40-day SMA and the blue Kijun-sen line. Rising above this strong hurdle would help shift the focus to the upside towards the 0.6215 peak, from the latest high and the 61.8% Fibonacci of 0.6230.

In the short-term, the bearish phase remains in play especially if prices continue to trade below the SMAs and under the key 0.6100 level.