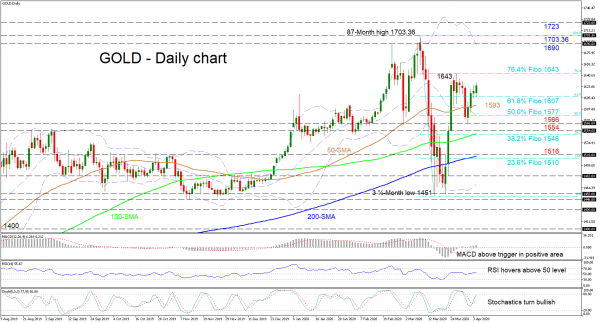

Gold’s fresh confidence is currently pushing off the 1,607 level – that being the 61.8% Fibonacci retracement of the down leg from 1,703.36 to 1,451 – following the recent positive sessions which commenced on April 1 from 1,566. Backing an improving near- and medium-term picture are all the inclining simple moving averages (SMAs) as well as the short-term technical indicators.

The MACD has remained above zero and is expanding above its red trigger line, while the RSI is hovering above its neutral 50 mark. Moreover, the stochastics have turned up and seem to be headed for overbought levels.

Moving northwards, initial resistance could come from the 76.4% Fibo of 1,643, which coincides with the latest swing high. Overrunning this, the commodity could rally to the upper Bollinger band coupled with the inside swing high of 1,690 from February 24. With buying interest persisting, a revisit to the multi-year high of 1,703.36 could unfold before attention shifts towards the 1,723 obstacle from December 2012.

If sellers retake control turning below the 61.8% Fibo of 1,607, the 50-day SMA at 1,593 could be next to hinder the drop towards the 50.0% Fibo of 1,577, where the mid-Bollinger band also resides. Diving past the key swing low of 1,566, a support region from the 1,554 obstacle to the 38.2% Fibo of 1,548 – which encompasses the 100-day SMA – could halt further loss of ground towards the 200-day SMA, encapsulated between the 1,516 hurdle and the 23.6% Fibo of 1,510.

Summarizing, the near-term picture is positive above the 1,566 low and, with the aiding SMAs, a break above 1,643 would repower this bias.