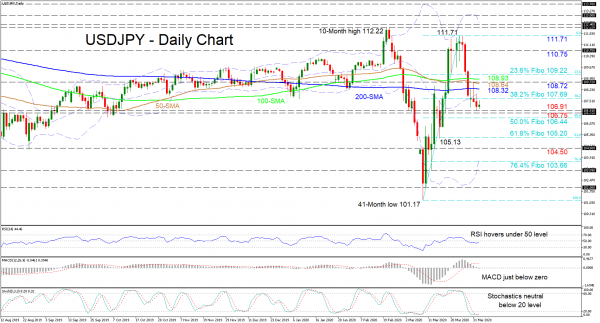

USDJPY’s latest slide that commenced on March 24 has sunk aggressively past all simple moving averages (SMAs) and under the 107.69 hurdle, that being the 38.2% Fibonacci retracement of the up leg from a 41-month low of 101.17 to 111.71. Currently, upside corrections seem limited by the mid-Bollinger band and the flattened and congested SMAs above.

Backing a stalled negative phase are the short-term oscillators, which suggest a paused state of directional momentum. The MACD, below its red trigger line has just dipped below the zero line, while the RSI is hovering below its neutral mark. Additionally, the stochastic lines have flattened in the oversold zone.

If sellers resurface and steer below the 106.91 and 106.75 immediate lows, they may need to challenge the 50.0% Fibo of 106.44 underneath, to confirm a continued plunge. Pushing past the 106.44 barrier, the 61.8% Fibo of 105.20 – just above the 105.13 important trough – could prove tough to drop below, if bears aim to head towards the 104.50 support and the lower Bollinger band around the 76.4% Fibo of 103.66.

Alternatively, initially restricting upside moves are the 38.2% Fibo of 107.69 and the mid-Bollinger band. Following, is a crowded area of obstacles from the 200-day SMA of 108.32 until the 23.6% Fibo of 109.22, which involves the 50- and 100-day SMAs as well as the nearby swing high of 108.72. Overtaking this resistance trench, the price may rally back to the 110.75 mark, of which if broken would see the test of the 111.71 peak unfold.

Summarizing, the near-term temperate pause in the market would require a clear break either above 108.72 or below 106.75 in order to restart the next move.