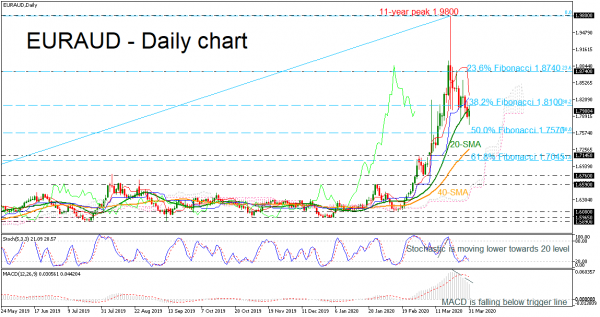

EURAUD has been in a downside correction mode following the sharp decline from the eleven-year peak of 1.9800 on March 19, dropping beneath the 20-period simple moving average (SMA) and the 38.2% Fibonacci retracement level of the upward wave from 1.5340 to 1.9800 at 1.8100.

Technically, the Stochastic is heading towards the oversold zone as the %K and %D lines completed a bearish crossover. Moreover, the MACD oscillator, standing in the positive zone, is holding below the trigger line and is losing its positive momentum.

Immediate support is coming from the 50.0% Fibonacci of 1.7570 ahead of the 40-day SMA currently at 1.7273 close to the 1.7145 level. Marginally below this hurdle, the 61.8% Fibo of 1.7045 could be in focus as any move below this region would send the market into a neutral trend.

Alternatively, if the pair successfully surpasses the 38.2% Fibo of 1.8100, it would hit the red Tenkan-sen line of 1.8274. More upside pressure could add some sentiment to traders for bullish actions towards the 23.6% Fibo of 1.8740. A strong rally above this barrier could send the price to the eleven-year top of 1.9800.

In the short-term, EURAUD has been pointing up over the past month, framing a positive profile. A continuation of the last aggressive bearish move would shift the bullish outlook to bearish, in case of a fall below the 61.8% Fibo of 1.7145.