Key Highlights

- GBP/USD started a strong upward move above 1.2200 and 1.2320.

- A key bullish trend line is forming with support at 1.2280 on the 4-hours chart.

- The US Pending Home Sales increased 2.4% in Feb 2020 (MoM).

- The UK GDP is likely to remain flat at 0% in Q4 2019 (QoQ).

GBP/USD Technical Analysis

After a major drop, the British Pound found support near the 1.1450 area against the US Dollar. GBP/USD started a strong upward move from 1.1450 and recovered above the 1.2000 barrier.

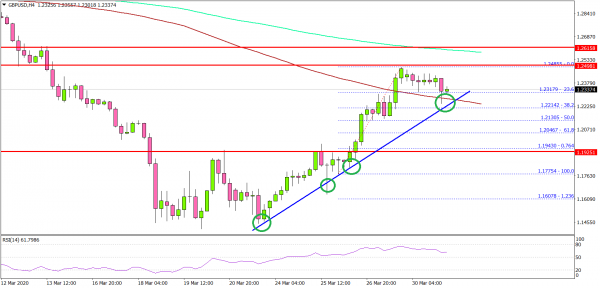

Looking at the 4-hours chart, the pair remained well bid and it climbed above the 1.2200 resistance level. It opened the doors for more gains above the 1.2320 and 100 simple moving average (red, 4-hours).

The pair traded close to the 1.2500 resistance and a high is formed near 1.2485. Recently, there was a downside correction below the 1.2400 level.

It tested the 23.6% Fib retracement level of the upward move from the 1.1775 swing low to 1.2485 high. On the downside, there is a decent support forming near the 1.2300 area.

There is also a key bullish trend line forming with support at 1.2280. If there is a downside break below the 1.2280 support area, the next support is seen near the 1.2135 level. It coincides with the 50% Fib retracement level of the upward move from the 1.1775 swing low to 1.2485 high.

Conversely, the pair might continue to rise above the 1.2485 and 1.2500 resistance levels. A successful close above the 1.2500 barrier could lift the pair towards the 1.2580 and 1.2600 resistance levels.

Fundamentally, the US Pending Home Sales for Feb 2020 was released by the National Association of Realtors. The market was looking for a 1.0% decline in sales in Feb 2020, compared with the previous month.

The actual result was better than the forecast, as the US Pending Home Sales grew 2.4% in Feb 2020. Besides, the last reading was revised up from 5.2% to 5.3%.

The report added:

Year-over-year contract signings increased 9.4%. An index of 100 is equal to the level of contract activity in 2001.

Overall, GBP/USD is showing positive signs and it could surge if it clears the 1.2500 and 1.2600 resistance levels. The next major hurdle is near 1.3000.

Upcoming Economic Releases

- UK GDP Q4 2019 (QoQ) – Forecast 0%, versus 0% previous.

- Euro Zone CPI for March 2020 (YoY) (Prelim) – Forecast +0.8%, versus +1.2% previous.

- Euro Zone Core CPI for March 2020 (YoY) (Prelim) – Forecast +1.2%, versus +1.2% previous.