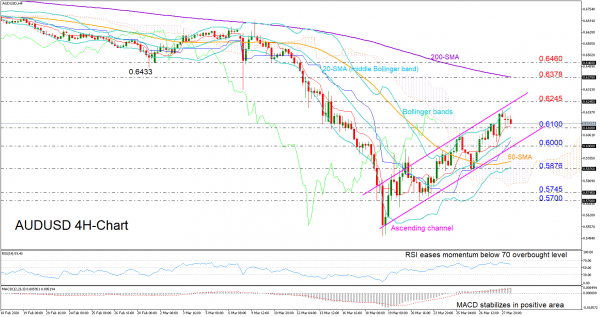

AUDUSD is charting indecisive moves on Monday on the four-hour timeframe as the pair seems to be preparing for some stabilization following the peak at a two-week high of 0.6199.

From a technical perspective, the pair has likely pressed the overbought button and a downside correction could be reasonable in the near-term as the price is pulling back below the upper Bollinger band, while the RSI is easing momentum after approaching its 70 overbought mark. The flattening MACD is sending some cautious signals, too.

The short-term market structure, however, could stay positive if the ascending channel keeps the price within it and the 20-period simple moving average (middle Bollinger band) continues to deviate above the 50-period SMA. The fact that the market managed to jump above the Ichimoku cloud is another encouraging sign.

Should the supportive red Tenkan-sen line at 0.6100 give up, traders could look for support near the middle Bollinger band and the bottom of the channel seen around 0.6000. Another downside break at this point could confirm additional losses towards 0.5876 where the bears were recently trapped, while lower the door would open for the 0.5745-0.5700 restrictive territory.

In case the bulls take over, the top line of the channel around 0.6245 could come back into play. Breaching that barrier, the rally could gain fresh steam towards the 200-period SMA currently at 0.6378, while slightly higher the former support area around 0.6460 could attract some attention, too.

Summarizing, AUDUSD is expected to experience some weakness within the ascending channel in the short-term. Any move out of the channel could change the market’s short-term trend accordingly.