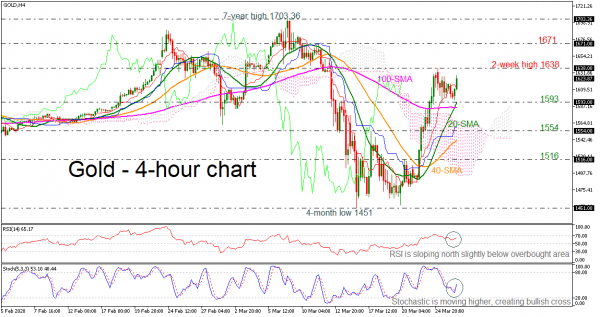

Gold prices continue to rise above the simple moving averages (SMAs), towards the two-week high of 1,638, stretching its upward movement from the four-month trough of 1,451.

According to the RSI, positive momentum could push for further gains in the short-term as the indicator picks up steam near its overbought zone. The stochastic oscillator is also advancing, creating a bullish crossover within its %K and %D lines. Also, the 20-period SMA crossed above the 40- and 100-period SMAs, confirming the recent trend.

To the upside, where the price continues to expand above today’s high, the next top could come from the previous peak at 1,638. If the market manages to overcome that area, traders could look for resistance at the 1,671 level, before bullish actions take the price up to the seven-year high of 1,703.36.

However, a downside move could stall at the 1,593 support, which coincides with the 20-period SMA. Marginally below this mark, the 100-period SMA currently at 1,584.62 could also provide support. Below that, the 1,554 area, inside the Icimoku cloud could trigger a further sell-off ahead of the 1,516 barrier.

Regarding the medium-term picture, the bullish outlook has built up as the commodity continues to recoup some losses that were posted in the previous couple of weeks.