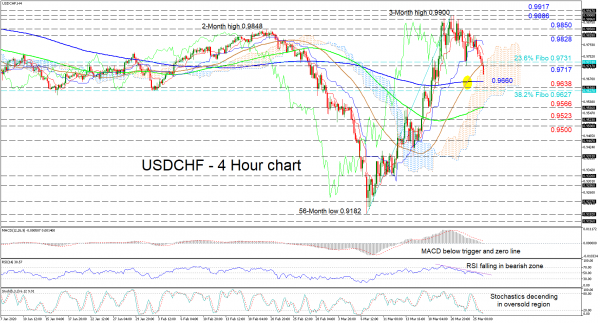

USDCHF is extending its downside correction off the 0.9900 peak past the fresh low of 0.9717 and into the Ichimoku cloud slightly underneath. Aiding this move is the recent bearish crossover within the declining Ichimoku lines and the strengthening negative demeanour in the short-term oscillators.

The MACD is descending under its red trigger line and has slipped below the zero mark, while the RSI is weakening in the bearish region. Moreover, the stochastic lines are sinking in the oversold territory, also promoting a negative move. That said traders need to be aware of the positive signals still reflected within the 50- and 100-period simple moving averages (SMAs), which could see a neutral-to-bullish picture return.

To the downside, immediate interference could come from the 200-period SMA at 0.9660. Diving down in the cloud, the swing low of 0.9638 and the 0.9627 obstacle beneath, which is the 38.2% Fibonacci retracement of the up leg from 0.9182 – 0.9900 could come next. If sellers manage to pierces out of the cloud, the 0.9566 barrier coupled with the 100-period SMA could challenge their efforts towards the 0.9523 and 0.9500 supports.

Alternatively, steering back above the area from the 0.9717 resistance to the 23.6% Fibo of 0.9731, the price could encounter some friction from the Ichimoku lines ahead of the 0.9828 and 0.9850 swing highs. Climbing higher, the focus could turn to the region of tops from 0.9886 to 0.9917, involving the 0.9900 three-month high.

Overall, a shift to the downside appears to be evolving in the near-term picture.