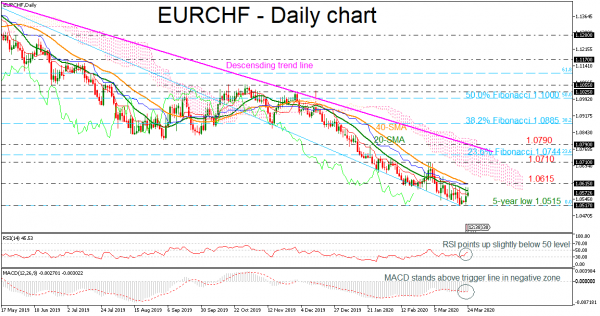

EURCHF is trading slightly above the five-year low of 1.0515, flirting with the 20-day simple moving average (SMA) and the immediate resistance at 1.0615, which coincides with the 40-day SMA. The market is remaining well below the descending trend line, creating a strong selling trend which began eleven months ago.

Technically, the RSI indicator is pointing up in the bearish zone, while the MACD is losing some momentum, surpassing the trigger line in the negative area.

Downwards, the bears could face immediate support from the almost five-year low of 1.0540, while the 1.0235 barrier, taken from the lows on April 2015, could be a trigger point for steeper bearish actions.

However, if the pair jumps above the 1.0615 resistance, it could hit the lower surface of the Ichimoku cloud at 1.0645. If the price continues to rise, resistance could next come somewhere near the 1.0710 barrier and the 23.6% Fibonacci retracement level of the down leg of 1.1470-1.0515 at 1.0744, where the downtrend line also lies. A successful attempt above this hurdle would increase optimism for more bullish actions.

Overall, EURCHF could gain some ground in the short-term, while in the long-term the pair continues to hold a negative outlook which began in April 2018.