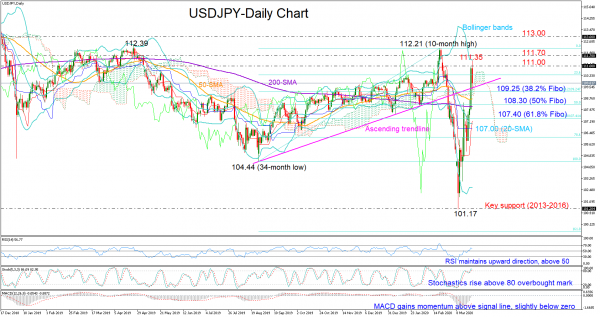

USDJPY reversed its massive sell-off near a familiar support level of 101.17, which was active during the 2013-2016 period, and accelerated above its simple moving averages (SMA) and back towards the 111.00 area.

On Thursday, the pair also managed to return above the broken ascending trendline, casting doubt on the prospect of a down-trending market, while all momentum indicators further strengthened, with the RSI gaining ground above its 50 neutral mark, the MACD increasing distance above its signal line and the Stochastics jumping into the overbought area. Adding to the positive signals, the red Tenkan-sen crossed above the blue Kijun-sen, suggesting that the bullish bias is still in place.

On Friday the pair resumed its bearish mode, pulling back into the 109.00 zone after touching the upper Bollinger band, but the ascending trendline seems to be curbing the downside correction now.

Should it hold, the price could re-challenge the 111.00-111.35 nearby resistance, while slightly higher there is another tough barrier between 111.70 and 112.20 that needs to be swept away for the rally to pick up steam towards the 113.00 number.

Alternatively, a drop below the trendline and specifically below 109.25, which is the 38.2% Fibonacci of the 104.44-112.21 upleg, could find support near the 50% Fibonacci of 108.30 and the 200-day SMA. Falling lower, the spotlight will turn to the 61.8% Fibonacci of 107.40 and the middle Bollinger band, a break of which could confirm additional losses ahead.

In the medium-term picture, the outlook improved to neutral after the peak above 108.30.

Summarizing, USDJPY could maintain a positive bias in the short-term if the ascending trendline successfully eases today’s negative move. In the medium-term, the pair is expected to hold neutral unless it forcefully rises above its previous high of 112.21.