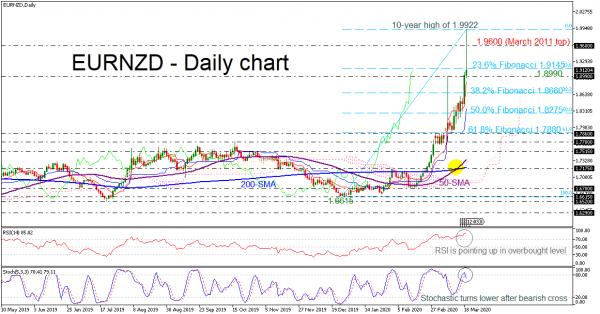

EURNZD found some footing around the ten-year high of 1.9922 before edging lower near the 23.6% Fibonacci retracement level of the upward move from 1.6615 to 1.9922 at 1.9145.

The red Tenkan-sen line, remains well above the blue Kijun-sen and the RSI is currently flirting with overbought levels, while the stochastic is turning lower into the positive area after the bearish cross within the %K and %D lines, which exited the overbought region.

A pull back may meet immediate support around the 1.8990 barrier, while lower the bears could try to overcome the 38.2% Fibonacci of 1.8660, which overlaps with the Ichimoku cloud. Should the price retreat under the latter level, the 50.0% Fibonacci of 1.8275 could come under speculation.

In the positive scenario, the pair could improve above the 23.6% Fibo to challenge a stronger resistance around the 1.9600 handle, reached in 2011. The ten-year high of 1.9922, however which strictly capped the bullish action today, remains the big highlight of the next few sessions.

Meanwhile, in the medium-term picture, the situation seems to be getting more interesting as the 50-day SMA and the 200-day SMA posted a golden cross. Should the lines continue their intersection and keep a large distance, the positive outlook may turn even brighter.