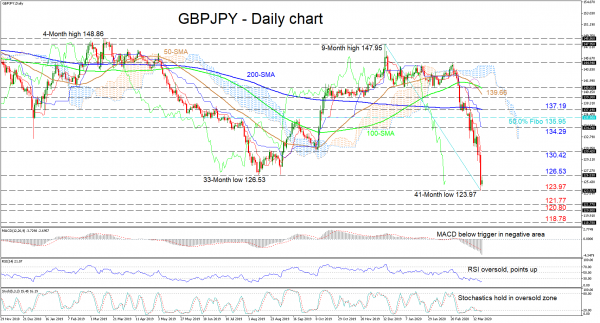

GBPJPY’s nearly one month decline, out of a consolidation phase, appears to have just about touched a fourty-one-month low of 123.97, assisted by the declining Ichimoku lines and the recent bearish crossover in the downward sloping 50- and 100-day simple moving averages (SMAs).

The short-term technical indicators confirm the extremely bearish picture and currently point to more weakness in the market. The MACD, in the negative area, continues to weaken below its red trigger line, while the RSI and stochastics, despite remaining in oversold territory, show signs of slight improvement. That said, due to oversold conditions, some caution is warranted in case buyers pick up.

Heading back south, initial support could come from the fresh multi-year trough of 123.97, which stretches back to October of 2016. If sellers penetrate below, the 121.77 and 120.80 obstacles from August of 2012 could halt further loss of ground towards the 118.78 low.

If buying interest increases, first to apply the brakes is the thirty-three-month inside swing low of 126.53. Overrunning this, the price may test the 130.42 hurdle where the Tenkan-sen line also lies. Moving up, the high of 134.29 could apply some friction to an ascent towards the 135.95 obstacle, which is the 50.0% Fibonacci retracement of the down leg from 147.95 to 123.97. Overcoming this too, the climb may come to a halt at the swing high of 137.19 where the 200-day SMA also resides.

Summarizing, a bearish mode below 134.29 and more importantly below 126.53 seems to exist in the short-term, with few signals of easing soon.