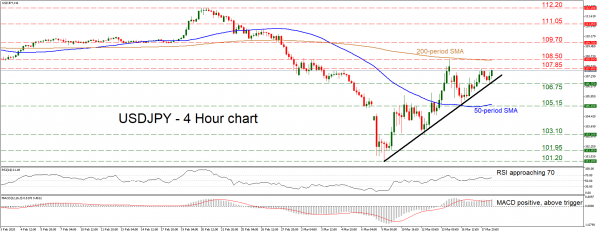

USDJPY fell sharply in recent weeks to touch 101.20, a level last seen on November 9, 2016 – the day Donald Trump was elected US president. The pair found fresh buy orders near that zone and then staged a major recovery, holding above a short-term uptrend line. On the four-hour chart, the price structure now consists of higher highs and higher lows, so the very near-term outlook seems to have turned positive. A break back above 108.50 could confirm that.

The RSI and the MACD suggest the latest upswing could continue for now. The former looks ready to test its 70 level soon, while the latter is positive and above its trigger line.

If buyers push above the 107.85 barrier, their next stop might be the crossroads of the 108.50 region and the 200-period simple moving average (SMA), currently at 108.42. Another bullish violation would add credence to the view that the short-term picture has turned positive, and perhaps open the way for a test of 109.70.

If sellers retake control, the first area to provide support might be the intersection of the 106.75 level and the uptrend line drawn from the March 9 low. A negative break would turn the focus to the 105.15 zone and the nearby 50-period SMA. If that territory fails to hold too, the very near-term outlook would shift back to neutral, and the 103.10 hurdle might come into play next.

In short, USDJPY looks cautiously positive in the immediate term. A move above 108.50 could shift the outlook to firmly positive, whereas a break below 105.15 would turn it neutral.