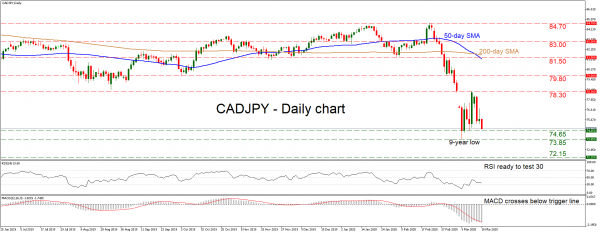

CADJPY has sold off aggressively in the past few weeks, with the pair falling to 73.85 – a zone last seen in 2011 – before rebounding somewhat. The outlook therefore seems to have turned negative, something endorsed by the 200-day simple moving average (SMA) crossing below the 50-day one to form a ‘death cross’. That said, a break below 73.85 is needed to confirm the downtrend.

Short-term oscillators paint a bearish picture too. The RSI looks ready to test its 30 level again, while the MACD – already deep in negative territory – has just fallen back below its red trigger line.

Another wave of losses could find initial support near 74.65, where a downside violation would turn the focus to the 73.85 area. If the bears pierce below that too, that would reaffirm that a downtrend is in place and turn the focus towards 72.15 – the 2011 low. Even lower, the 2008 low near 70.70 might halt further declines.

On the upside, the first obstacle for the bulls might be the 78.30 area. If they overcome it, the next target would likely be the 79.80 zone, where another positive break could open the door for a test of 81.50.

Summarizing, the recent plunge has turned the picture negative, though a break beneath 73.85 is required to recharge the bears.