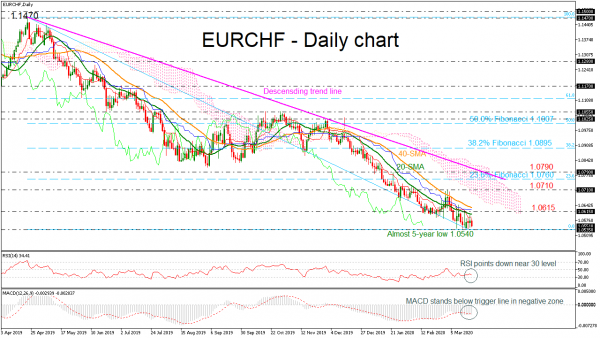

EURCHF has been declining over the last eleven months, driving the pair towards the almost five-year bottom of 1.0540 on March 12. The market is remaining well below the descending trend line and close to the 20- and 40-period simple moving averages (SMAs) in the daily timeframe.

Technically, the RSI indicator is pointing down in the bearish zone and marginally above the oversold region, while the MACD is stretching its negative momentum below the trigger line, suggesting an extension of the south movement.

The immediate support of the almost five-year low of 1.0540 could be the immediate support for the bear, while the 1.0235 barrier, taken from the lows on April 2015 could be a trigger point for steeper bearish actions.

However, if the pair reverses back to the upside, investors could first hit the 1.0615 resistance, which overlaps with the lower surface of the Ichimoku cloud and holds between the 20- and 40-day SMAs and then at 1.0710. If the price continues to rise, resistance could next come somewhere near the 23.6% Fibonacci retracement level of the downleg of 1.1470-1.0535 at 1.0760 and the 1.0790 resistance, near the falling trend line.

In brief, EURCHF could lose further steam in the short term, while in the long-term the pair continues to hold a negative outlook since April 2018.