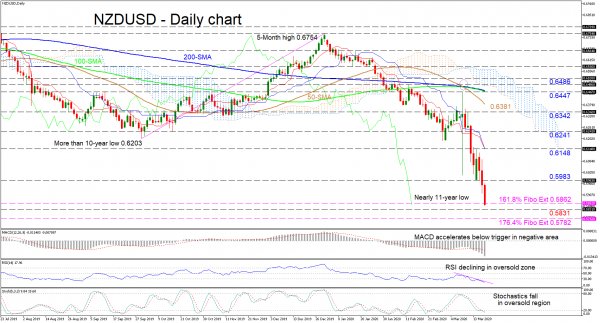

NZDUSD continues to extend its negative sentiment reaching the 0.5862 level – that being the 161.8% Fibonacci extension of the up move from 0.6203 to 0.6754 – backed by the declining Ichimoku lines and the recent bearish crossover by the downward sloping 50-day simple moving average (SMA) of the 100- and 200-day SMAs.

Further aiding the drop in price is the MACD, which is in the negative region, currently increasing bearish momentum below its red trigger line, while the RSI continues to fall in the oversold territory. Moreover, the stochastics %K and %D lines are also steering lower in the oversold zone.

To the downside, immediate support arises from the 161.8% Fibo extension of 0.5862 ahead of the 0.5831 low, coming from back in May of 2009. Pushing past this, the 176.4% Fibo extension could move into the spotlight before the focus turns to the 0.5526 low and the 0.5443 inside swing high from April and February of 2009 respectively.

If buyers shift the price back up, initial resistance could come from the 0.5983 level, ahead of the 0.6148 high and the Ichimoku lines overhead. Moving up, the 0.6241 barrier could provide some friction climbing towards the 0.6342 high and the 50-day SMA at 0.6381. Surpassing the 50-day SMA, a key area from the 0.6447 peak to the 0.6486 nearby swing high – which encompasses the 100- and 200-day SMAs – could prevent further advances.

Summarizing, the short-term picture appears to be increasingly bearish as the price distances itself below its moving averages.