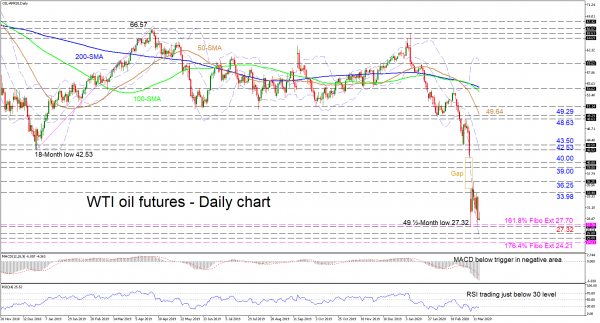

WTI oil futures continues to reflect signals of a negative market after breaking the 49.29 low and even plummeting past the 18-month trough of 42.53 from December 2016, which resulted in the commodity gapping towards a multi-year bottom of 27.32.

The short-term oscillators maintain a negative picture with the MACD, in the negative zone, declining deep below its red trigger line, while the RSI hovers in the oversold territory, flirting with the 30 mark. Worth mentioning is the intact bearish signals within the downward sloping simple moving averages (SMAs) and the distance created between them and the price.

To the downside, sellers could encounter the 27.70 hurdle – that being the 161.8% Fibonacci extension of the up leg from 42.53 to 66.57 – and fresh 49-month bottom of 27.32 underneath. Managing to dive below, the 26.00 and 25.00 round numbers could draw traders’ attention before the 176.4% Fibo extension of 24.21.

If buyers shoot back up, first resistance may come at the 33.98 recent high ahead of the 36.25 one. Attempting to close the gap, buyers could face some friction at the 39.00 and 40.00 levels ahead of the 42.53 to 43.50 area, which also encompasses the mid-Bollinger band. Surpassing this too, next to challenge the climb could be the 48.63 swing peak and the nearby 49.29 inside swing low with the 50-day SMA overhead.

Summarizing, the commodity appears to sustain a negative outlook in the near-term. That said, only a close below 27.32 could prolong the bearish picture and keep the structure oversold.