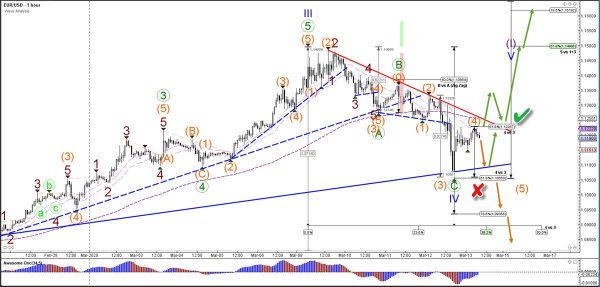

Dear traders, the EUR/USD made a bearish breakout during yesterday’s interest decision in the Eurozone. Price broke below the key support at 1.1225 and fell towards the 61.8% Fibonacci level.

The EUR/USD made an impressive decline in January 2020 but the rise was even strong in February 2020. What will the month of March bring us? The only thing that seems certain is volatility. With the Coronavirus creating havoc on the global economy and stock markets, the outlook remains precarious. Eventually, stock markets might show some recovery but the question is at what level. The US Dollar could strengthen if the crisis becomes deeper, using its role as a safe haven to recover. That said, if the US were to get hit harder than the EU in March, then its currency could get slightly lose one more round before the USD is expected to recover some ground again as a retracement of the large up swing. Technically, a break below the 61.8% Fib aims for the 78.6% Fib. A break above the resistance could develop a pullback and continue towards the previous top and maybe 1.16 target.