Key Highlights

- USD/CHF started an upside correction from the 0.9185 monthly low.

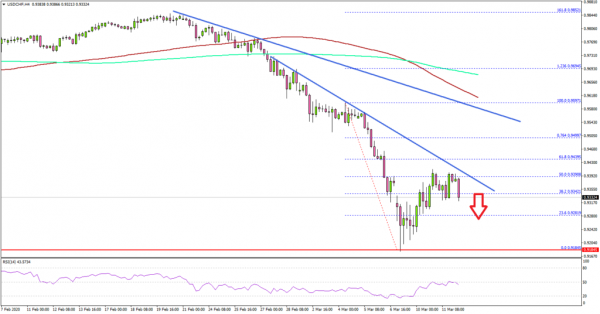

- Two bearish trend lines are forming with resistance near 0.9430 and 0.9500 on the 4-hours chart.

- The US CPI increased 2.3% in Feb 2020 (YoY), more than the 2.2% forecast.

- The US Initial Jobless Claims for the week ending March 07, 2020 could rise from 216K to 218K.

USD/CHF Technical Analysis

The US Dollar started a strong decline from well above 0.9500 against the Swiss Franc. USD/CHF even dived below the 0.9320 support area and spiked below 0.9200 before starting an upside correction.

Looking at the 4-hours chart, the pair traded as low as 0.9185 and settled well below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, the pair managed to recover above the 0.9280 resistance, plus the 23.6% Fib retracement level of the downward move from the 0.9597 swing high to 0.9185 low.

However, the 0.9400 area seems to be acting as a strong resistance. Besides, the 50% Fib retracement level of the downward move from the 0.9597 swing high to 0.9185 low is near the 0.9390 level.

More importantly, there are two bearish trend lines forming with resistance near 0.9430 and 0.9500. Therefore, the pair is likely to face a lot of hurdles above the 0.9400 level in the near term.

On the downside, an initial support is near the 0.9280 level, below which the pair could revisit the 0.9200 and 0.9185 support levels.

Fundamentally, the US Consumer Price Index for Feb 2020 was released by the US Bureau of Labor Statistics. The market was looking for a 2.2% rise in the CPI compared with the same month a year ago.

The actual result was above the market forecast, as the US Consumer Price Index increased 2.3% in Feb 2020. Looking at the monthly change, there was a 0.1% increase in the CPI, whereas the market was looking for no change.

The report added:

Increases in the indexes for shelter and for food were the main causes of the increase in the seasonally adjusted all items index, more than offsetting a decline in the energy index. The food index increased 0.4 percent over the month, with the food at home index rising 0.5 percent, its largest monthly increase since May 2014.

Overall, USD/CHF could correct further, but it is likely to struggle above 0.9400. Looking at EUR/USD, the pair is likely to resume its upside above 1.1380 while GBP/USD declined sharply below 1.2950.

Upcoming Economic Releases

- US Initial Jobless Claims – Forecast 218K, versus 216K previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.