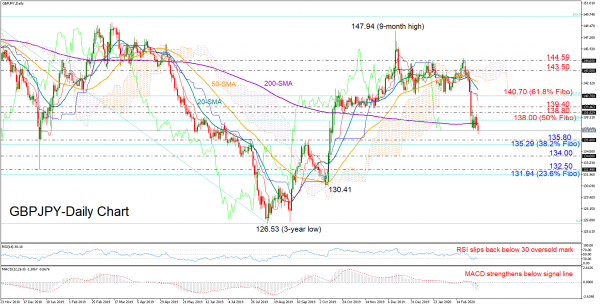

GBPJPY is resuming negative momentum below the 200-day simple moving average (SMA) after some consolidation in the past few days that took the form of a bearish rectangle in a smaller timeframe (look at 4-hour chart).

The next move in the price is likely to be down as the RSI is reversing south again and the MACD keeps deviating below its red signal line, though an upside correction cannot be ruled out as the former is entering oversold waters. The confirmed bearish cross between the 20- and the 50-day SMAs is another negative indication for the short-term trading.

Yet the nearest key support area where the sell-off could take a breather is seen between 135.80 and the 38.2% Fibonacci of 135.29 of the 149.47-126.53 down leg. Should the bears clear that wall, the 134.00 level could be re-tested before a sharper downside takes place towards 132.50 and the 23.6% Fibonacci of 131.94.

On the flip side, the pair should close above the 138.80 resistance and more importantly above the 139.40 barrier in order to re-challenge the 61.8% Fibonacci of 140.70. Running higher, the price could next stop somewhere between 143.50-144.59.

In the medium-term picture, the market has restored its downward direction following the break below 138.80.

In brief, GBPJPY is viewed as bearish both in the short- and the medium-term pictures.