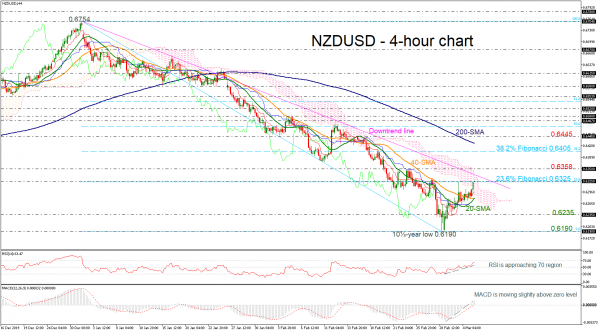

NZDUSD has gained ground this week, advancing above the ten-and-half-year low of 0.6190 and the short-term moving averages, with the technical indicators feeding prospects for a possible positive trading. The RSI holds well above 50, while the MACD continues to strengthen in bullish territory and above its red trigger line. Also, in Ichimoku indicators, the red Tenkan-sen keeps rising higher the blue Kijun-sen. Yet, the pair is facing strong resistance near its previous peak of 0.6325 and the two-month descending trend line.

A failure to overcome the 23.6% Fibonacci level of the down leg 0.6754 – 0.6190 at 0.6325 could send the price down to the 40- and the 20-day simple moving averages (SMAs) at 0.6280 and 0.6274 respectively. Lower, support could be next found around 0.6235, while a decisive close below it could stage steeper sell-off towards the multi-year low of 0.6190.

Alternatively, if the price successfully surpasses the significant 0.6325 resistance and the falling trend line could open the door for the 0.6358 barrier, taken from the peaks on February 24. Above that, would increase neutral to bullish move until the 38.2% Fibo of 0.6405 and the 200-day SMA at 0.6428.

In the medium-term picture, NZDUSD has been in a short-term bullish correction and would probably find strong resistance at the immediate level of 0.6325. Should the market continue the upward move, the outlook may turn brighter. A run above the 200-day SMA may change the outlook from negative to slightly positive. A pull back on the downtrend line would continue the longer-term bearish structure.