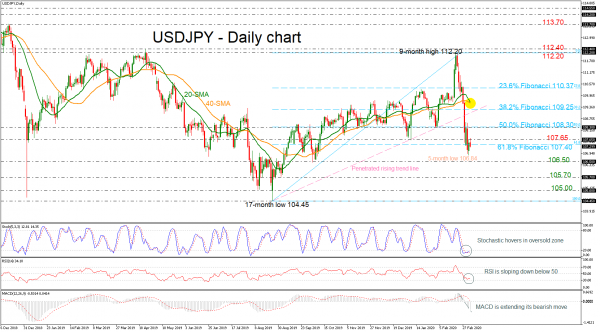

USDJPY is looking strongly bearish in the short-term after plummeting below its moving averages in the preceding week and penetrating the ascending trend line. Prices hit a five-month low of 106.84 on Wednesday and the technical indicators are all pointing to further negative momentum in the near term.

The stochastics are heading downwards, and the %K line crossed below the %D line in the oversold zone, suggesting plenty of scope for additional southward moves on price. The RSI is hovering in the negative territory but has yet to approach the 30 level. Moreover, the MACD is extending its bearish momentum well below its trigger and zero lines. It is also worth noting that the moving averages are ready for a negative crossover in the next sessions, raising sentiment for a bear market.

If the pair violates the 61.8% Fibonacci retracement level at 107.40 of the upleg of 104.45-112.20, it could again see losses extending towards the 106.50 support, registered on March 3. Even lower, the bears could stall around the 105.70 barrier where the September sell-off stopped.

If the market corrects higher, the bullish action may pause initially near 107.65 before attention shifts to 108.30 which overlaps with the 50% Fibonacci and above that could hit the 38.2% Fibo of 109.25. A rally on top of the latter and the 20- and 40-day simple moving averages (SMAs) currently at 109.60 would probably stage fresh buying pressure, with the price moving next to the 23.6% Fibo of 110.37.

In the medium-term picture, USDJPY would resume its upside trend above the nine-month peak of 112.20, while a dive below the 105.00 handle and the 17-month trough of 104.45 would bring the bearish outlook back into play.