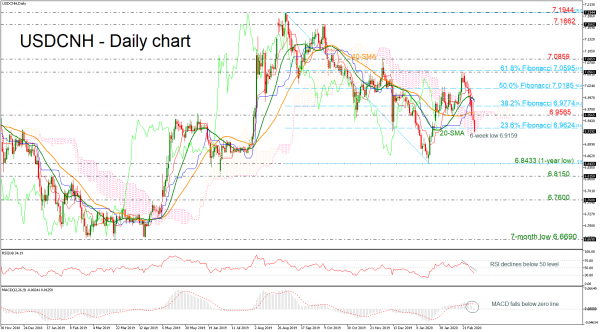

USDCNH is plunging for the ninth consecutive day after the pullback on the 7.0561 resistance, breaching the 23.6% Fibonacci retracement level of 6.9624 of the down leg from 7.1944 to 6.8433 today. The price is also registering a six-week low of 6.9159 within the Ichimoku cloud.

Technical indicators are moving south with the RSI approaching its 30 oversold mark and the MACD dropping below its zero level, while the red Tenkan-sen is preparing to cross below the blue Kijun-sen line.

If the market closes successfully below the 23.6% Fibonacci of 7.0561 the spotlight could turn to the one-year low of 6.8433. Below that region, the door could open for the 6.8150 mark, identified by the bottom on July 2019.

Alternatively, a successful jump above the Ichimoku cloud and the 6.9565 resistance, could push the pair towards the 38.2% Fibonacci of 6.9774. A significant rally above this area, would increase bullish sentiment, opening the way towards the 50.0% Fibo of 7.0185 if the 20-day simple moving average approves the move up.

Meanwhile in the six-month picture, the pair is in a bearish mode with a strong downside run over the last sessions. A dive below the one-year low of 6.8433 would cement the negative trend.