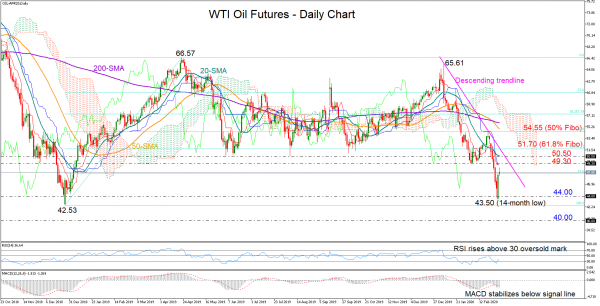

WTI oil futures for April delivery slipped as low as 43.50 on Monday and near 2018 lows before bouncing up on Monday. With the RSI rising above its 30 oversold mark and the MACD stabilizing below its signal line, the market could follow a sideways path in the coming sessions.

Any attempt for improvement could hit a wall within 49.30-50.50 area, where the 20-day simple moving average (SMA) and the descending trendline are currently standing. Should the price overcome that zone, breaking the 61.8% Fibonacci of 51.71 of the upleg from 41.53 to 66.57 too, then the way would open towards the 50% Fibonacci of 54.55.

Alternatively, a reversal to the downside could re-challenge the tough 44-00-43.50 supportive area, which if fails to hold would shift the spotlight towards the 42.53 trough from December 2018. Breaching that bottom, the sell-off could stretch to 40,00, turning at the same time the bigger picture from neutral to bearish.

In brief, WTI oil futures could consolidate in the short-term above recent troughs. In the bigger picture, the commodity is trading at the bottom of its range and any downfall below 42.53 would resume the bearish sentiment.