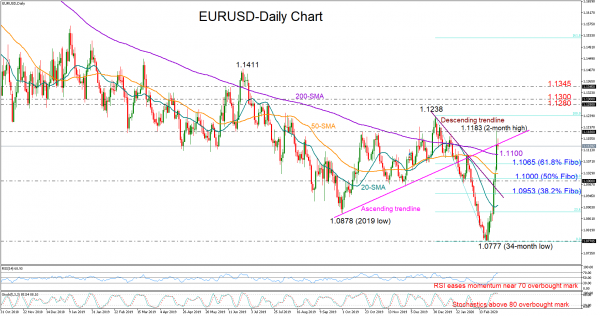

EURUSD bulls forcefully entered the 1.1100 territory on Monday and peaked at a two-month high of 1.1183, but failed to close above the former supportive ascending trendline even though the pair pierced through it.

The price also surpassed the 200-day simple moving average (SMA) but the RSI and Stochastics are currently flagging overbought conditions, suggesting that some downside pressure or some consolidation may emerge in the near-term.

A pullback below the 200-day SMA and the 1.1100 level could stall around 1.1065, where the 61.8% Fibonacci of the downleg from 1.1238 to 1.0777 lies. Slightly lower, the area between the 50-day SMA and the 1.1000 mark may next attract attention, while beneath that it would be interesting to see whether the descending trendline, seen around the 38.2% Fibonacci of 1.0953, could also stop the sell-off.

On the upside, the price needs to close above the ascending trendline and particularly above the 1.1180 barrier to reach the December peak of 1.1238. If such an action takes place, traders could search for nearby resistance within the 1.1280-1.1300 zone and then around 1.1345.

Meanwhile in the medium-term timeframe, the outlook switched from negative to neutral following the rally above 1.0888. The next upgrade could come above 1.1238.

Summarizing, EURUSD could take a breather from rising in the short-term unless it manages to close above 1.1180. In the medium-term picture, the pair is trading neutral and only a climb above 1.1238 would shift the outlook to positive.