EUR/USD

Current level – 1.1057

The successful break of the resistance zone at 1.1040 increased positive momentum and the short-term sentiment is now positive for a rise and test of the next more significant resistance at 1.1090. Today, the data for the ISM manufacturing for February (15:00 GMT) may have a more significant impact for the price movement.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1090 | 1.1240 | 1.1035 | 1.0940 |

| 1.1170 | 1.1240 | 1.0990 | 1.0900 |

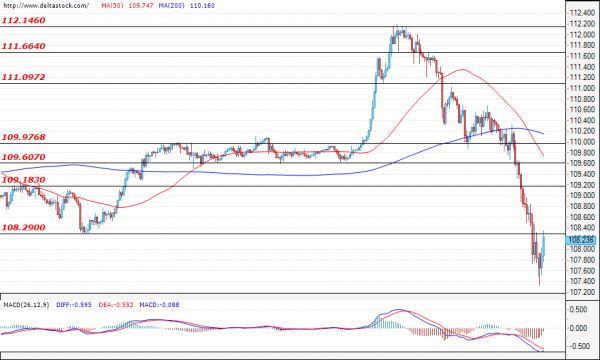

USD/JPY

Current level – 108.23

During the last week, investors turned to the Japanese yen as a safe haven because of the growing concerns about the global economy, fueled by the increasing threat of the coronavirus. The currency pair broke through the main support at 108.30, reaching levels of around 107.30. At the time of writing this analysis, the yen is almost nearing a test of the resistance level at 108.30 and a breakthrough at this level could push the pair to the next resistance area at 109.20.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 108.20 | 109.60 | 107.60 | 105.90 |

| 109.20 | 110.00 | 106.90 | 105.00 |

GBP/USD

Current level – 1.2830

The currency pair managed to break the support level at 1.2870, but the bulls managed to limit the sales to a level of 1.2750. The sentiment is positive for a test of the first resistance at 1.2870 and a move towards 1.2900. More significant economic news for today would be the data for the UK Manufacturing PMI (09:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2870 | 1.2940 | 1.2750 | 1.2530 |

| 1.2900 | 1.2990 | 1.2670 | 1.2350 |