Key Highlights

- Gold price surged to a new multi-month high at $1,689 before correcting lower.

- A major bullish trend line is forming with support near $1,640 on the 4-hours chart of XAU/USD.

- The US GDP increased 2.1% in Q4 2019 (Prelim), in line with the forecast.

- The US Personal Income is likely to increase 0.3% in Jan 2020 (MoM).

Gold Price Technical Analysis

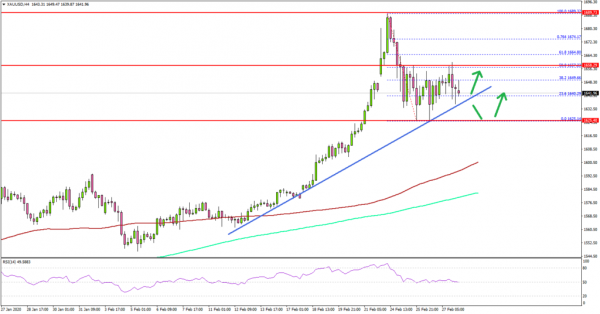

This month, gold price rallied further above the $1,650 resistance level against the US Dollar. The price even surged above the $1,680 level and traded to a new multi-month high at $1,689 before correcting lower.

The 4-hours chart of XAU/USD indicates that the price corrected lower below the $1,665 and $1,658 support levels. It even declined below the $1,640 level, but remained well above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (4-hours, green).

A swing low is formed near $1,625 and the price is currently rising. It surpassed the $1,650 level and tested the 50% Fib retracement level of the downside correction from the $1,689 high to $1,625 low.

If there is a clear break above the $1,665 resistance level, the price could revisit the $1,689 swing high. Any further gains might lead gold price towards the $1,700 resistance area.

On the downside, there are many supports near the $1,640 and $1,635 levels. Besides, there is a major bullish trend line forming with support near $1,640 on the 4-hours chart of XAU/USD.

Therefore, dips remain well supported above $1,640 and the price is likely to continue higher. Conversely, a close below $1,625 is needed for a strong bearish wave.

Fundamentally, the US Gross Domestic Product Annualized for Q4 2019 (Prelim) was released by the US Bureau of Economic Analysis. The market was looking for a 2.1% growth in the GDP.

The actual result was in line with the forecast, as the US GDP increased at an annual rate of 2.1 percent in the fourth quarter of 2019, according to the “second” estimate.

The report added:

Current dollar GDP increased 3.5 percent, or $184.2 billion, in the fourth quarter to a level of $21.73 trillion. In the third quarter, GDP increased 3.8 percent, or $202.3 billion.

Overall, gold price is likely to continue higher towards $1,670 and $1,680. Looking at EUR/USD, there was a strong comeback and rise above the 1.0900 resistance area. Conversely, GBP/USD declined below the 1.2950 support area.

Economic Releases to Watch Today

- German CPI for Feb 2020 (YoY) (Prelim) – Forecast +1.7%, versus +1.7% previous.

- German CPI for Feb 2020 (MoM) (Prelim) – Forecast +0.3%, versus -0.7% previous.

- US Personal Income for Jan 2020 (MoM) – Forecast +0.3%, versus +0.2% previous.

- Canadian GDP for Q4 2019 (Annualized) – Forecast +0.3%, versus 1.3% previous.