Key Highlights

- USD/CHF started a downside correction from the 0.9848 swing high.

- There was a break below a key bullish trend line with support at 0.9828 on the 4-hours chart.

- The US New Home Sales increased 7.9% in Jan 2020 (MoM).

- The US GDP could increase 2.1% in Q4 2019 (Preliminary, Annualized).

USD/CHF Technical Analysis

This past week, the US Dollar traded to a new yearly high at 0.9848 against the Swiss Franc. Later, USD/CHF started a downside correction and traded below the 0.9800 support area

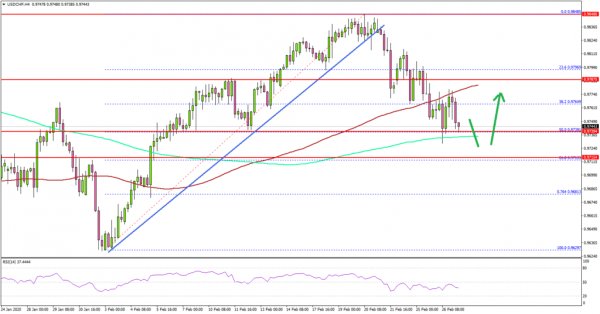

Looking at the 4-hours chart, the pair declined below the 0.9780 support level and a key bullish trend line. It opened the doors for more losses and the pair even spiked below the 100 simple moving average (red, 4-hours).

It tested the 0.9740 support level and the 200 simple moving average (green, 4-hours). Moreover, the 50% Fib retracement level of the upward move from the 0.9629 low to 0.9848 high acted as a support.

The pair is currently consolidating above the key 0.9740 support. The next major support is seen near the 0.9715 level, plus the 61.8% Fib retracement level of the upward move from the 0.9629 low to 0.9848 high.

On the upside, the 0.9800 level is an initial hurdle for the bulls, above which the USD/CHF pair might continue to rise towards the 0.9850 resistance.

Fundamentally, the US New Home Sales report for Jan 2020 was released by the US Census Bureau. The market was looking for a 3.5% increase in the sales compared with the same month a year ago.

However, the actual result was well above the market forecast as the number of new home sales increased 7.9%. Besides, the last reading was revised from -0.3% to +2.3%.

Overall, USD/CHF remains well supported for a fresh increase above 0.9800. Conversely, EUR/USD and GBP/USD lost momentum and are likely to resume their decline.

Upcoming Economic Releases

- Euro Zone Consumer Confidence Feb 2020 – Forecast -6.6, versus -6.6 previous.

- US Initial Jobless Claims – Forecast 212K, versus 210K previous.

- US Gross Domestic Product Q4 2019 (Preliminary) – Forecast 2.1% versus previous 2.1%.