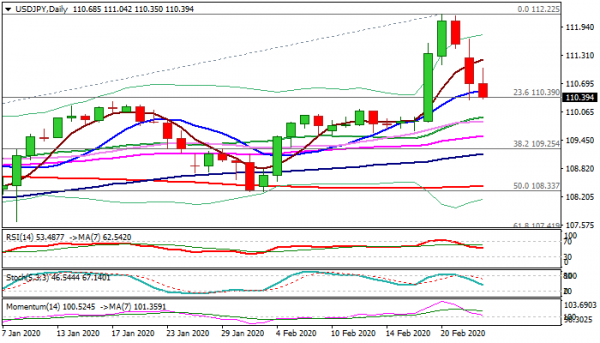

The pair extends weakness from double rejection at 112.22/18 into third day and retests Fibo support at 110.39 (23.6% of 104.44/112.40 ascend) which contained Monday’s fall.

Dovish steer from Fed in rising expectations that the US central bank may cut interest rates this year increased pressure on greenback.

Fresh bears so far retraced 76.4% of last week’s 2% two-day advance (109.83/112.22) signaling that recent steep rally is over.

Strong weakening of bullish momentum and daily stochastic / RSI heading south, add to negative signals.

Clear break of 110.39/26 pivots (Fibo 23.6% / daily Tenkan-sen) would further firm bears for test of psychological 110 support (reinforced by rising 20DMA) and last Wednesday’s low (109.83), which guard next key level at 109.25 (Fibo 38.2% of 104.44/112.22).

Today’s close below broken daily Tenkan-sen (110.92) is needed to confirm bearish stance.

Res: 112.22, 112.40, 112.66, 113.17

Sup: 111.61, 111.48, 111.24, 110.92