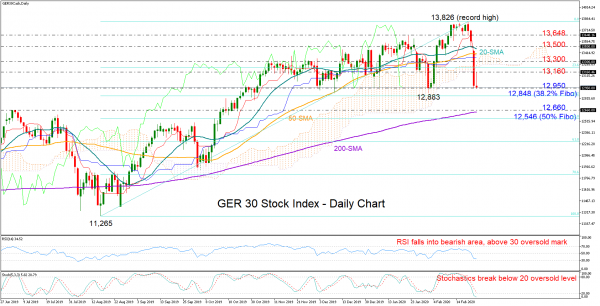

The German 30 stock index, having unlocked a fresh record high at 13,826 last week, plummeted below the Ichimoku cloud for the first time since August on Monday but the strong cluster of support around 12,950 managed to curb the sharp downfall once again.

Technically, there is more downside in store in the near-term according to the RSI and the Stochastics which are fluctuating comfortably within the bearish zone but have yet to confirm oversold conditions.

This increases the case for a re-test of the previous low of 12,883 which is not far above the 38.2% Fibonacci of the 11,265-13,826 upleg. Any violation of this barrier could generate additional losses towards the 12,660 -12,546 zone formed by the 200-day simple moving average (SMA) and the 50% Fibonacci.

On the upside there is a tough resistance between 13,160 and 13,300 that needs to be brushed away for the price to test the 20-day SMA and the 13,500 barrier ahead of the 13,648 handle.

Looking at the bigger picture, Monday’s sell-off attempted to violate the market’s upward direction, though the price did not close below the previous low of 12,883, keeping the uptrend valid for now. The rising 50-day SMA that maintains a bullish cross with the 200-day SMA since April suggests that an outlook reversal may happen later than sooner.

In brief, the GER 30 index could see additional weakness in the short-term if the 12,950 support collapses. The upward direction in the bigger picture could also come into question if the previous low of 12,883 gets violated too.