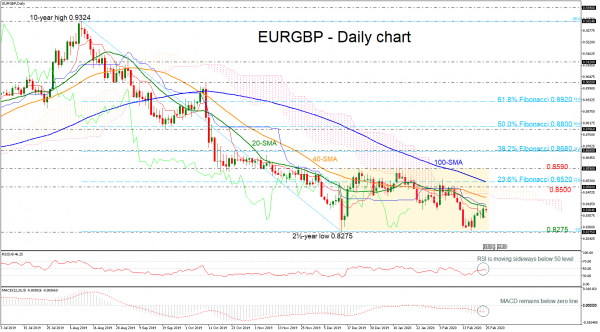

EURGBP is consolidating within a trading range over the last two months with an upper boundary at the 0.8590 resistance and the lower boundary at the 0.8275 support level. Currently, the pair is capped by the 20-day simple moving average (SMA) and the blue Kijun-sen line.

The technical indicators are moving with weak momentum within the bearish territory; the MACD has risen marginally above its trigger line, while the RSI is still flattening slightly below 50 area.

If the price retreats, it could find support at the two-and-a-half-year low of 0.8275 and any violation of this barrier would shift the neutral mode to strongly negative, flirting with the 0.8115 support, taken from the inside swing peak of April 2016.

In the alternative scenario, a run above the 20- and 40-day SMAs and the Ichimoku cloud could drive the price towards the 0.8500 psychological mark. More upside pressure could challenge the 23.6% Fibonacci retracement level of the down leg from 0.9324 to 0.8275 at 0.8520, which coincides with the 100-day SMA. Jumping higher, the upper boundary of the range of 0.8590 could be the next target.

In short, EURGBP is bearish in the long-term timeframe and neutral in the short-term.