Key Highlights

- GBP/USD started an upside correction from the 1.2850 support area.

- A key bearish trend line is forming with resistance near 1.3000 on the 4-hours chart.

- The Chicago Fed National Activity Index (CFNAI) increased from -0.51 to -0.25 in Jan 2020.

- The US CB Consumer Confidence could increase from 131.6 to 132.0 in Feb 2020.

GBP/USD Technical Analysis

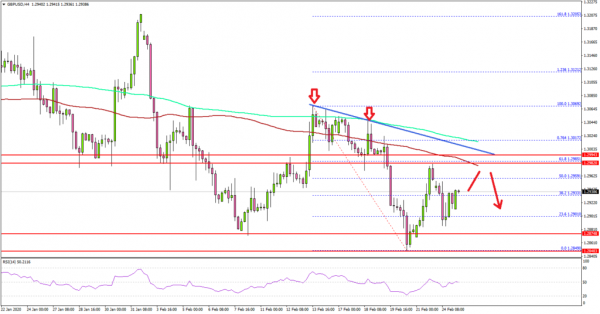

This past week, the British Pound declined heavily from the 1.3070 area against the US Dollar. GBP/USD revisited the 1.2850 support area and recently started an upside correction.

Looking at the 4-hours chart, the pair recovered above the 1.2900 and 1.2920 resistance levels. Moreover, there was a break the 50% Fib retracement level of the downward move from the 1.3069 high to 1.2849 low.

However, the pair struggled to continue higher above the 1.2980 resistance level and the 100 simple moving average (red, 4-hours).

Besides, the pair struggled near the 61.8% Fib retracement level of the downward move from the 1.3069 high to 1.2849 low. More importantly, there is a key bearish trend line forming with resistance near 1.3000.

Therefore, GBP/USD could struggle to continue above the 1.3000 resistance area. If it succeeds, there might be a strong increase towards the 1.3050 and 1.3080 resistance levels.

Conversely, the pair may perhaps start a fresh decline below the 1.2900 level. The main support is still near the 1.2850 level, below which the bears could aim a test of the 1.2750 level.

Fundamentally, the Chicago Fed National Activity Index (CFNAI) for Jan 2020 was released by Federal Reserve Bank of Chicago. The market was looking for a decline in the index from -0.35 to -0.92.

However, the result was well better than the forecast, the Chicago Fed National Activity Index (CFNAI) increased from -0.51 (revised from -0.35) to -0.25 in Jan 2020.

The report added:

All four broad categories of indicators that make up the index increased from December, but only one of the four categories made a positive contribution to the index in January.

Overall, GBP/USD must surpass 1.3000 for a sustained upward move. Besides, EUR/USD started a decent recovery from the 1.0780 area, but it is facing many hurdles.

Upcoming Economic Releases

- German GDP for Q4 2019 (YoY) – Forecast 0.3%, versus 0.3% previous.

- German GDP for Q4 2019 (QoQ) – Forecast 0%, versus 0% previous.

- US CB Consumer Confidence Feb 2020 – Forecast 132.0, versus 131.6 previous.