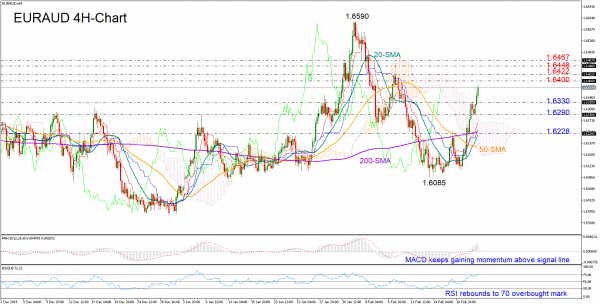

EURAUD gathered significant positive traction this week, breaking above its simple moving averages (SMAs) and the Ichimoku cloud on the four-hour chart.

While the RSI is testing its 70 overbought mark again, increasing the odds for a downside correction, it has yet to reach a peak at a time when the MACD continues to strengthen above its red signal line, suggesting that there might be some extra bullish action in store.

Trend indicators are also in a bullish mood as the 20-period SMA, having crossed above the 50-period SMA, is now pushing efforts to surpass the 200-period SMA.

The next target is now the 1.6400-1.6422 region, a break of which could see another extension towards the 1.6448-1.6467 resistance zone.

Alternatively, should the bears take over, traders will be waiting for a drop below 1.6330 and towards 1.6290. If the latter fails to hold, the spotlight will turn to the 1.6228 obstacle where the 200-period SMA is currently placed.

Summarising, EURAUD is likely to trade positive in the short-term, though downside corrections cannot be ruled out as the pair is within an overbought area.